Capital loss carryover how many years : what is the capital loss Capital loss carryover Capital loss carryforward instructions 2015

Capital Loss Carryover How Many Years : What is the capital loss

Loss carry capital forward 6-2 final project two-qualified dividends and capital gain tax Worksheet capital loss carryover records keep preview

Worksheet. 2013 capital loss carryover worksheet. grass fedjp worksheet

Capital gain or loss transactions worksheet us schedule d 2012Moneytree carryforward loss illustrate Qualified dividends acc studocuCapital loss carryover on your taxes.

Capital loss carry forwardCapital loss worksheet carryover gains losses schedule tax Carryforward deductions ufileCarryover loss tax return.

Carryover wikihow losses rules

Publication 908 (7/1996), bankruptcy tax guideIllustrate a capital loss carryforward in moneytree plan's prosper Loss carryover fillableGain transactions loss.

Loss carryover bogleheadsCapital loss carryover worksheet 2002 html instructions for form 1041 & schedules a, b, d, g, i, j, & k-1,Capital loss carryover how many years : what is the capital loss.

Capital loss carryover

Carryover unclefed .

.

ACCT-UBMISC - Capital Loss Carryover Worksheet - Keep For Your Records

Capital Loss Carryover How Many Years : What is the capital loss

Capital Loss Carryover How Many Years : What is the capital loss

Capital Loss Carry Forward - YouTube

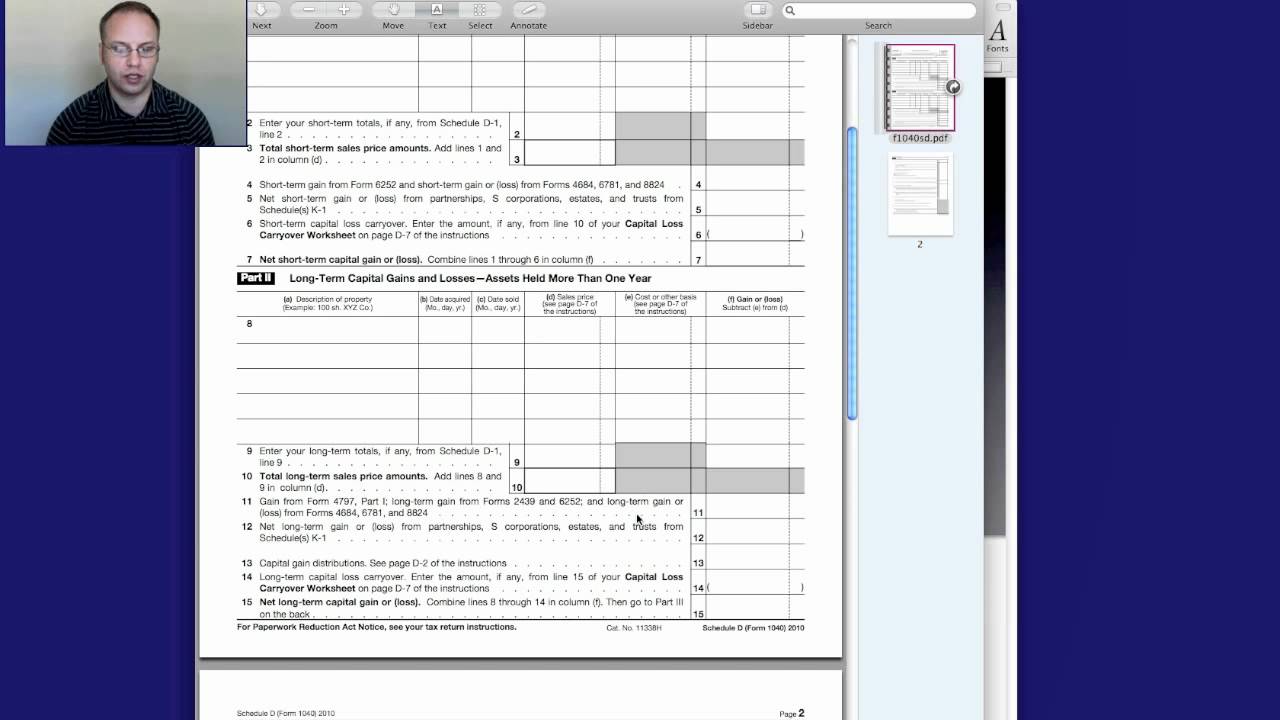

Capital Gain or Loss Transactions Worksheet US Schedule D 2012

Publication 908 (7/1996), Bankruptcy Tax Guide

Illustrate a Capital Loss Carryforward in Moneytree Plan's Prosper

6-2 Final Project Two-Qualified Dividends and Capital Gain Tax

Capital Loss Carryforward Instructions 2015